After missing the initial deadline of May 2017, On April 2018, the Narendra Modi government announced that the electrification of all inhabited villages in India has been completed. While the announcement and achievement are significant, it is still largely symbolic and not substantive in nature as electrification of villages does not translate into electrification of households and is certainly no guarantee for power availability. Devil lies in details, in the definition of what means 100% electrified village, and as per the Union power ministry’s definition, a village is said to be electrified if at least 10% of the households in it have power connections and if electricity is provided in public places such as schools, panchayat offices, health centres and community centres. One shouldn’t be surprised if one encounters a village where there is just 1 bulb light on a bamboo pole and the village is declared as electrified, hence, even though 100% electrification of villages has been achieved, government data shows that as of today, there are still 31 million households without electricity. In states like Uttar Pradesh, Jharkhand and Assam, fewer than 60% of households have electricity, four years after the BJP came to power on the promise of “electricity for all”. In 12 out of the 30 states, fewer than 80% of the households have been electrified. The Modi government has promised to deliver uninterrupted power supply to all households by March 2019, which seems to be a much more difficult task.

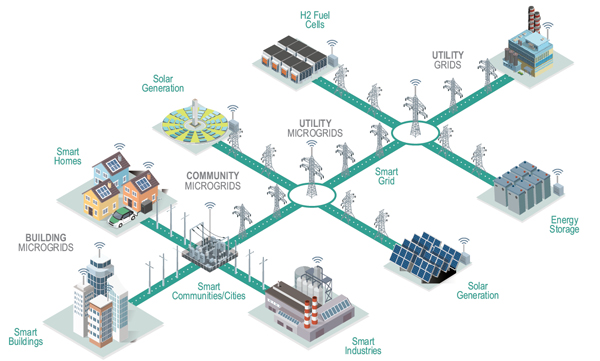

Most of these un-electrified areas across different states are miles away from the grid and hence it is only advisable to take a call on grid extension vs evaluating off-grid solution basis the population that needs to be supplied with electricity and the projected demand for power. India is blessed with abundant sources of renewable energy like, wind, solar, small hydro power, and if these cheaply available resources are harnessed along with energy storage solutions, in a microgrids set-up, it can provide reliable and consistent power supply, in remote rural areas. Further, such microgrids enable the infusion of investment at the community level and provide an avenue for revenue generation to the communities through the feed-in tariff mechanism. In addition, by installing distributed generation assets throughout the network, utilities can fall back on them for ancillary services during times of emergency. Microgrids not only enable the maximum integration of renewable energy, but also provide greater load flexibility and better demand management. In an attempt to promote microgrids in India, the government issued a draft national policy on renewable energy based mini- and microgrids. The policy proposes to set up at least 10,000 renewable micro-and minigrid projects across the country, with 500 MW of generation capacity to be developed by private players by 2022 in order to cater to around 237 million people experiencing energy shortage.

Microgrids utilise various generation resources including diesel, solar photovoltaic (PV), micro-hydro and biomass gasification, and also employ hybrid technologies such as wind-diesel and PV-diesel. While diesel-based microgrids are the most commonly used globally, solar PV systems are also gaining popularity due to the reduced cost of PV modules and solar PV equipment. In India, solar microgrids with an aggregate capacity of 1,899 kWp have been installed so far in 63 villages with financial support (30 per cent of the project cost) from the Ministry of New and Renewable Energy (MNRE). Thus, for a 10 kW direct current microgrid, the MNRE offers Rs 105 per watt, and for systems with a module capacity of 10-250 kW, it offers Rs 90 per watt. The systems come with a minimum warranty of five years in the rural and remote areas of the country. In India, key players in the microgrid market include Gram Power, Mera Gao Power, DESI Power, Omnigrid Micropower Company and Gram Oorja Solutions. Most of these players deploy solar-based microgrids in combination with smart grid technologies in states such as Karnataka, Maharashtra, Uttar Pradesh and Bihar. Currently, commercial investors are sceptical about investing in the microgrid market due to a perceived lack of visibility, market maturity, and scalability concerns. Given the increasing global focus on renewable energy generation and commitments to counter climate change, microgrids offer a range of benefits. There are challenges but the advantages outweighs these and the technology interventions, government support will pave way for economically sound micro-grid based power distribution system which is self-sustainable, operates in tandem to grid or on a complete independent grid basis. InfraInsights research report “Micro grid opportunity in India: Identifying Unelectrified Locations that are best fit for electrification through microgrids”, outlines why micro-grid which has only scratched the surface is likely to become huge in India market and it’s a perfect PPP model to achieve 100% household level access to electricity by 2024-25. Micro-grids utility will be beyond last mile connectivity and will find its way into industrial captive power, commercial captive and even at individual residence cluster level.

- Executive Summary

- Research Approach & Methodology

- Decentralized Distributed Generation in India

- About Micro-grids & its technology landscape

- Components of micro-grid

- Types of micro-grid

- New types of micro-grid

- Policy Initiative to promote Microgrid in India

- Benefits & Challenges associated with micro-grids

- Adoption barrier

- Integration challenges

- Micro-grids progress & potential in India

- Microgrid installations across India

- Estimated Potential

- Projects in pipeline

- Potential locations, clusters for micro-grid project

- Governance, Policy & Regulations on Microgrid in India

- Draft policy on micro and mini grids

- MNRE definition of a Microgrid

- Proposed tariff structure

- Permits & Clearances

- State level regulations and policies on micro-grid

- Case studies / profile of operating micro-grid projects in India market – evaluating successes, challenges & key learning’s

- Key companies in India in the Microgrid solution providers in India

- Products, Projects & Services

- Business model of a micro-grid & perceived barriers

- Business Model

- Lighting only

- Lighting plus

- Anchor Load

- Barriers

- Threat of grid extension

- Payment system

- Funding

- Project scale and size

- Poor demand for power

- Levelized cost of electricity

- Grid parity

- Business Model

- Go-To Market Strategy

We create value for our customers by amalgamating deep functional and energy industry expertise. Our solutions range from in depth research reports to advisory services enabling our customers with energy market insights to take informed decisions, grow and improve on their competitiveness.

Leveraging our breadth of geographical reach we provide solutions in entire energy value chain be it coal, power, oil and gas or renewable. We are a reliable and efficient source comprising of best in class talent pool which provides answer to all the challenges of the energy industry

We create value for our customers by amalgamating deep functional and energy industry expertise. Our solutions range from in depth research reports to advisory services enabling our customers with energy market insights to take informed decisions, grow and improve on their competitiveness.

Leveraging our breadth of geographical reach we provide solutions in entire energy value chain be it coal, power, oil and gas or renewable. We are a reliable and efficient source comprising of best in class talent pool which provides answer to all the challenges of the energy industry