Trade war between US and China, Corporate Tax Cut by India and Improvement in Ease of Doing Business in India augurs well for the Indian economy assuming that the slowdown in global economy do not last long and resumes growth trajectory soon. All the macro indicators augurs well for Indian economy and slew multiple reform announced by Indian government to stem the slowdown in economy is anticipated to yield results in 2-3 quarters from now. India is certainly one of the most favoured investment destinations and every company in the world would want to take advantage of the new economy that’s shaping under Modi 2.0. The recent cut in corporate tax rate for existing companies to 22 percent from 30 percent, and to 15 percent from 25 percent for new manufacturing firms incorporated after October 1, 2019, and starting operations before March 31, 2023 is a bold move by the Government of India. This move has made India a very attractive destination for foreign investment. India’s corporate tax rates have become very competitive compared to those of other emerging market economies in ASEAN and other parts of Asia. For any company that plans to make new investment, no country is offering 15 per cent tax rate. We are giving 15 per cent with no MAT (minimum alternate tax) and simpler taxation structure. The economy that is reeling under slowdown, this is a bold reform that will enable India resume its growth trajectory on the back anticipated increase in foreign direct investment. The cut in corporate tax rate has coincides with the improvement India has seen in its ease of doing business, India’s rank in the World Bank’s Ease of Doing Business 2020 index has vaulted 14 places to 63rd among 190 economies.

When it comes to making Go-No Go decision on new investment, it becomes important to do in-depth analysis beyond the headline indicators, this becomes more important when a company is entering in a market where state specific variables can make successful outcome a difficult task. With over 29 states and 7 union territories, shortlisting investment location is not an easy task and InfraInsights aims to enable companies to take informed decision by understanding the attractiveness and risks associated with each state in India, especially when it comes to make right investment decision. InfraInsights research report “State Investment Attractiveness Index: Evaluating Go-To States for Setting up Manufacturing Facility in India”, will enable companies to find out which are the best Go-To states for making Fresh Investment in India. The report aims to do a competitive benchmarking of leading states on parameters like resource attractiveness, policy attractiveness, political attractiveness, environmental attractiveness, infrastructure attractiveness, industry attractiveness and based on all parameters shortlist most attractive investment location /cluster in a given state. The research is a mix of qualitative and quantitative benchmarking which will help companies take informed decision. The report will also help companies that have taken decision on investing in India but are evaluating which state in India it should set up shop basis factors like availability of land, labour, water, electricity, political stability, proximity to port, roads and highway infrastructure etc.

- Executive Summary

- Approach & Methodology – Market Attractiveness Framework

- Overview on Indian Economy

- Reforms under Modi 1.0 and 2.0

- Key Industries in India

- Manufacturing

- Automobile

- Steel

- Cement

- Electrical & Electronics

- Chemical

- Others

- Most Industrialized States in India

- Shortlisting States for Investment Attractiveness Analysis [12-15 States]

- PESTEL

- Capex

- FDI

- Region wise -East, West, North, South

- Investment Attractiveness Index of Key Industrialized States in India

- Resources Attractiveness: Resources Availability & Competitiveness

- Land

- Water

- Electricity

- Labour

- Raw Materials

- Policy Attractiveness: Government Enabling Policies & Regulations

- Number of Permits & Clearances Required

- Politics Attractiveness: Political Stability

- Environmental Attractiveness

- Weather / Climate / Temperatures

- Natural Calamity etc – Flood, Earthquake instances

- Infrastructure Attractiveness

- Proximity to Ports

- Infrastructure

- Road

- Railways

- ICDs

- Warehouses

- Industry Attractiveness: Maturity of Existing Industries

- Which industries are present in state & why?

- What is the state GDP category

- Key Locations / Cluster

- InfraInsights recommendation which are the key cluster for setting up new manufacturing facility

- Best suited for which type of industry

- Resources Attractiveness: Resources Availability & Competitiveness

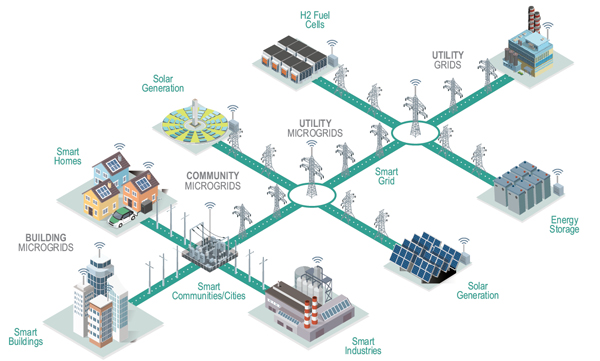

We create value for our customers by amalgamating deep functional and energy industry expertise. Our solutions range from in depth research reports to advisory services enabling our customers with energy market insights to take informed decisions, grow and improve on their competitiveness.

Leveraging our breadth of geographical reach we provide solutions in entire energy value chain be it coal, power, oil and gas or renewable. We are a reliable and efficient source comprising of best in class talent pool which provides answer to all the challenges of the energy industry

We create value for our customers by amalgamating deep functional and energy industry expertise. Our solutions range from in depth research reports to advisory services enabling our customers with energy market insights to take informed decisions, grow and improve on their competitiveness.

Leveraging our breadth of geographical reach we provide solutions in entire energy value chain be it coal, power, oil and gas or renewable. We are a reliable and efficient source comprising of best in class talent pool which provides answer to all the challenges of the energy industry